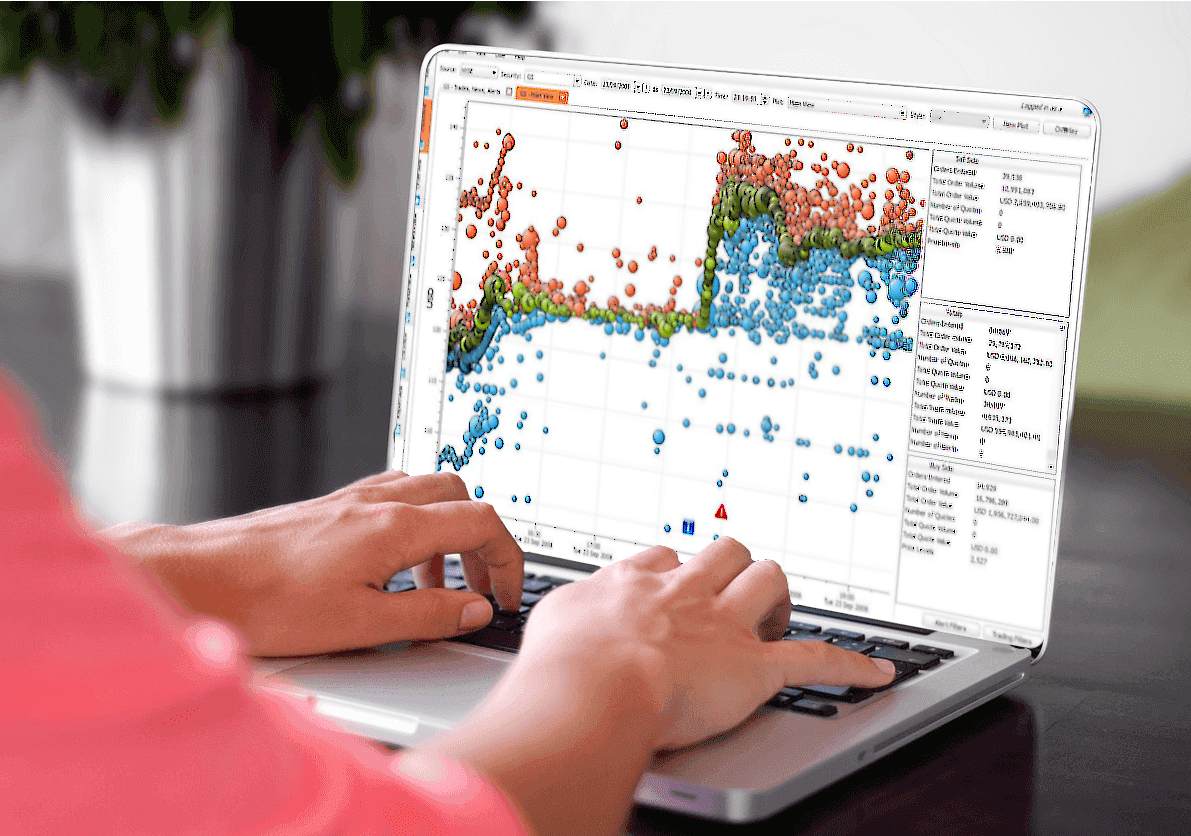

Trading Room Surveillance and Compliance Platform

STP house is happy to present IRISIUM by KRM22

IRISIUM is a highly sophisticated, yet easy to deploy and use, monitoring and surveillance platform for exchanges, brokers-dealers, investment firms and regulators. We help improve market integrity by providing greater visibility over trading behaviour. Our real-time independent approach to monitoring, analytics, alerting and reporting helps firms identify and manage potential risks of market abuse, fraud and operational shortcomings. With IRISIUM, firms can meet their regulator obligations with confidence.

Highly sophisticated monitoring and surveillance platform for exchanges, brokers-dealers, investment firms and regulators.

IRISIUM provides high performance processing, Alerting, Monitoring, Cross-Source Visibility and Data Normalization.

- Manages cross-market surveillance and multiple asset classes

- Provides cross-asset class surveillance

- Supports crypto as well as all traditional asset class

- Facilitates real time aggregate monitoring

- Combines news and social media with market data

- Manages huge data sets on multiple channels

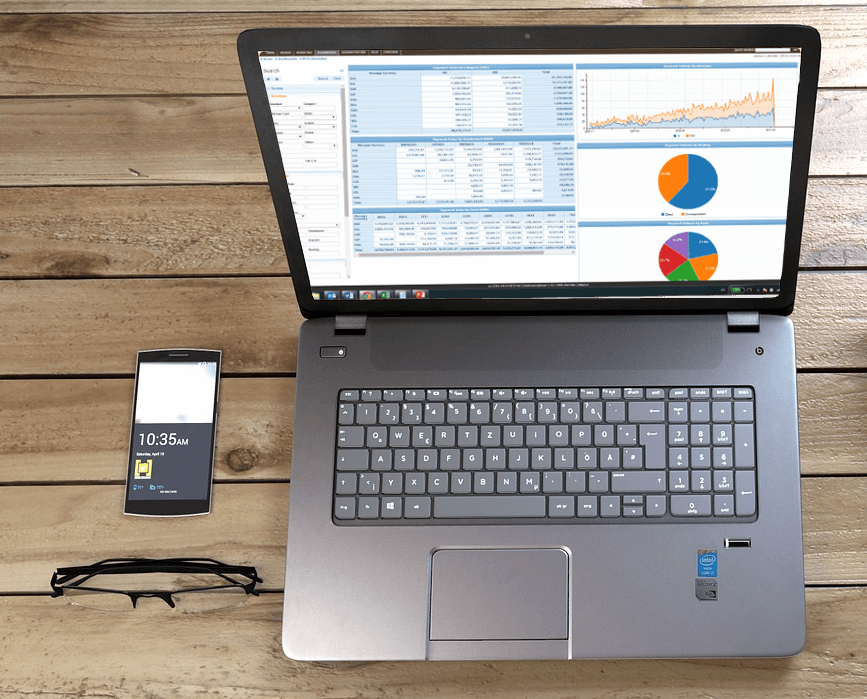

Messaging Archiving and BI solution

STP house is happy to present Intix

Intix helps financial institutions to view, monitor and aggregate financial messages. Not only does it act as a central, advanced archiving solution, Intix is also a dedicated solution for managing and analyzing relationships and costs between banks – number of messages, types, frequency, change over time, fees, and more, as well as the ability to give a picture of the business analysis and in-depth operational across all in and out traffic.

Intix helps the bank analyzing and managing relationships with other financial institutions, creates broad and deep business picture and expose vital information that is otherwise not accessible.

- Single window access to all your financial messaging data, from real-time to long-term archives

- Powerful search functionality, structured and unstructured

- Customizable reports, with export function (Excel & Pdf)

- Advanced, personalized dashboard showing your relationship trend, costs and status with any counterparty

- Simple and fast implementation

- Support both ISO20022 and older standards in transparent view

AUTOMATED SWIFT REGRESSION TOOL

STP house developed the most advance way to save costs and increase your confidence before the next AMH upgrade

AMH is a mission critical application and a healthy, functioning connectivity to SWIFT is essential for any bank. However, as AMH tends to change from time to time (due upgrades or fixes) and the business environment is changing (changing of the flow logic or introduction of new functionality), there is a constant need for testing, and a constant pressure to save efforts and time. We can map several key challenges for proper testing of SWIFT with AMH interface:

- Lack of time and resources– One of the key challenges for clients running AMH is to perform testing in an efficient manner. There are many reasons and occasions in which a full AMH regression test is required. However, as internal resources are limited, and timeline is critical. We see that banks are taking short cuts and only performing limited scope testing.

- Testing in an artificial manner– There is a saying “one can never test enough to be ready for SWIFT in production”. The reason is that testing BIC’s differs from testing production BIC’s, and the test messages are created specifically for the goal of testing. This is not a true, complete representation of reality.

- Testing coverage is limited– the usual focus is on testing the “progression”, which means focusing the testing on the new parts added to the system, whilst the existing logic that require a full regression, is kept without proper testing.

The Solution – AMH auto regression tool (FVT)

In STP house we have identified the client needs and created the FVT (Flow Verification Tool). It brings the following value to the clients:

- Expand the testing coverage scope

- Reduce the required effort to run full regression

- Shorten the time for a full AMH regression

- Enhance the testing quality in a significant manner.

Auto Regression of AMH logic by “recording” all production traffic, turn it into testing data, and running it through the upgraded/ tested system (system under test). An automated report compares the messages flow and history on the production instance vs the test instance and highlights any differences. All is done in a full automated manner

- Full regression of all production traffic (in/out) over the upgraded system, without any SWIFT connectivity, thus reducing network messaging cost

- Allows testing of REAL production messages (and not “synthetic” test data),

- Wider and deeper test coverage, based on real-life events

- Increases the quality and confidence for major releases and for any patch/fix or changes in the client environment

- Saves time and MDs effort by full regression automation